At Your Money Habit, we feel strongly about the fact that traditional budgeting does not work and no matter how hard you try, you are wasting your time.

At Your Money Habit, we feel strongly about the fact that traditional budgeting does not work and no matter how hard you try, you are wasting your time.

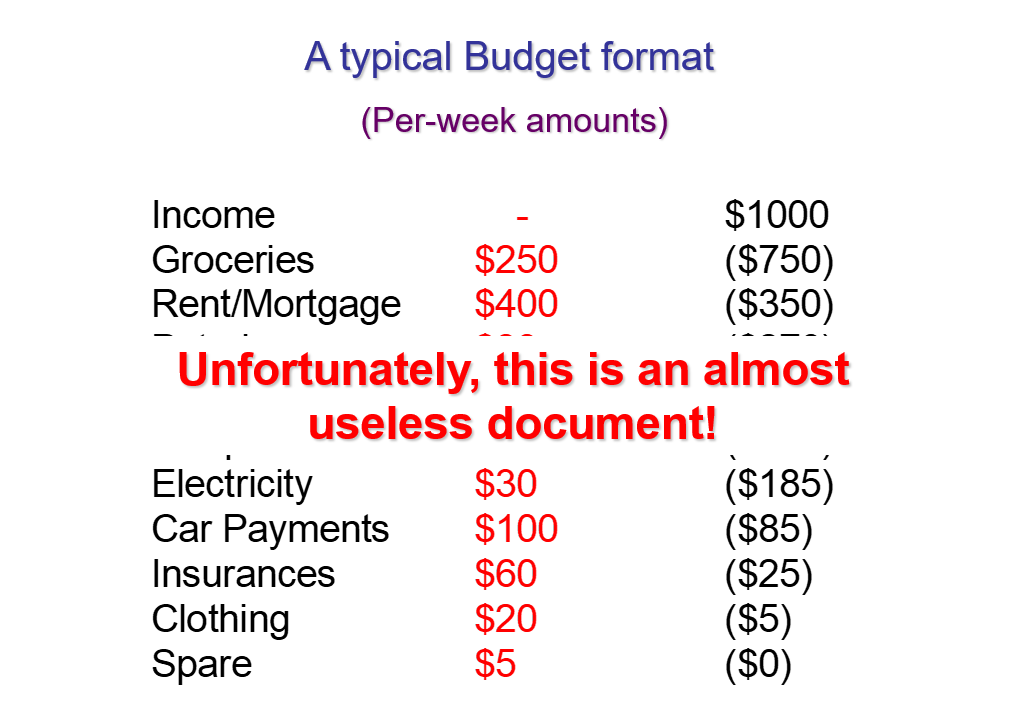

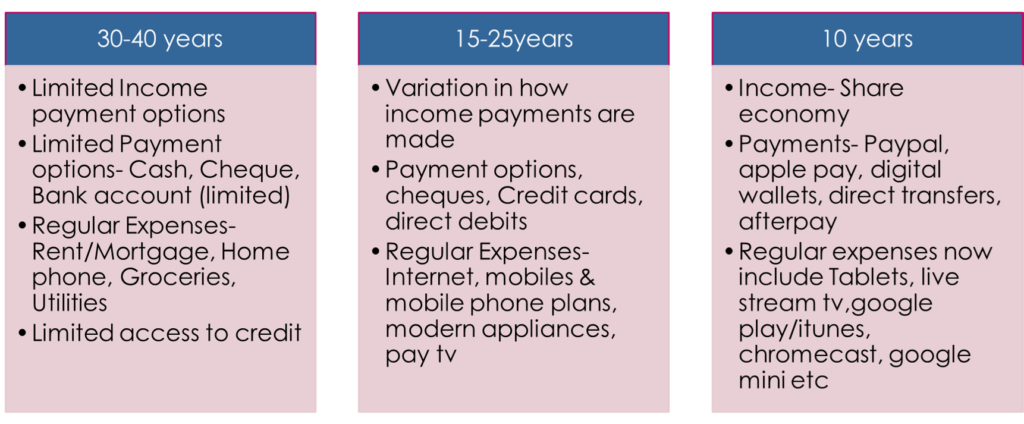

Before we go any further, let us get clear on what we mean by traditional budgeting.

We’re talking the pen and paper approach or

excel spreadsheets where you start with your income, list your expenses and hope you end up at least breaking even.

In fact, we’re not even a fan of apps that expect you to document every time you spend a cent.

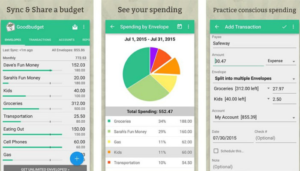

So why do we say that these methods don’t work? Because traditional budgeting is outdated and does not fit our lifestyles anymore.

Once upon a time, you’d go to one job, get one regular wage and then pay out a handful of regular expenses usually all with cash but now we have an overwhelming amount of payment options, an overload of what is now deemed as necessities and easy access to credit.

In the table below you can see how much things have changed in a relatively short period of time.

Q: If our lifestyles have changed so much then how can the same old budgeting ideas be effective planning strategies for us?

A: They can’t and they don’t. We need to adapt, we need to change our approach and learn a new way of doing things that suits our current lifestyle.

So what does work?

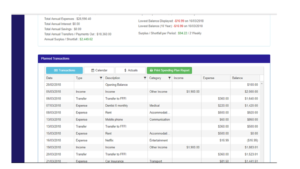

We promote spending  planning instead of budgeting. This approach essentially has you create your bank account and credit card statements in advance. Instead of waiting until after the damage is done, we pre-plan what your accounts will look like in a specialised software system. Once it works in the system then you can feel confident that it will work in real life.

planning instead of budgeting. This approach essentially has you create your bank account and credit card statements in advance. Instead of waiting until after the damage is done, we pre-plan what your accounts will look like in a specialised software system. Once it works in the system then you can feel confident that it will work in real life.

No more

- wondering if you’ll have enough money to pay everything

- trying to figure out when your bills are due

- annual bills that jump out and surprise you

- overspending accidentally

- guessing if your financial decision is sound

- sleepless nights due to financial anxiety

Millions of people around the globe are living payday to payday wishing for a way out of the cycle trying to use the same old approaches to get out of it. Isn’t it time you give yourself a break and try a new approach if it hasn’t been working for you.

This is one of the strategies we use to assist people in breaking free of living payday to payday. If you or someone you know are wanting to breakfree of living this way read the blog or book a seat at our Breakfree from living payday to payday online workshop.

About Amira MacCue Founder of Your Money Habit

Award Winning Spending Planner

Dedicated to teaching people how to overcome financial stress long term and be confident about their future using improved money management techniques and habit change.